I haven’t hit “Accept” just yet and hopefully won’t have to. But I was able to toggle through the options available to my family and me through our servicer, Quicken Loans.

I have seen a lot of chatter from real estate (agents and mortgage) pros in my networks about the supposed pros and cons of taking advantage of the forbearance provision in HR 748, the so-called CARES Act (“Coronavirus Aid, Relief & Economic Security Act”). Under the new law, borrowers with Federally-backed mortgage loans may request a forbearance (i.e., a cessation or reduction of payment) for up to 180 days; and, they may request to extend the forbearance for another 180 days after the initial period. All the borrower needs to do is attest to the fact that they will find it difficult to make their mortgage payments on account of COVID-19.

Negative Effect on Credit Rating. Let’s put one thing to rest quickly. I’ve seen warnings that “missing payments will negatively affect credit rating.” The Act specifically prohibits creditors from reporting negative information (e.g., a missed mortgage payments) to the credit bureaus if the borrower and servicer have an “accommodation” in place. That means that if the servicer has agreed to the forbearance, they may not report the missed payments under the agreement to the credit bureaus. Credit crisis averted.

Example of Quicken Loans Forbearance Plan under CARES Act.

My home loan was recently sold/transferred to Fannie or Freddie, can’t remember which. It’s serviced by Quicken Loans and was originated through a local bank here is southwest Florida. In the Quicken portal, there is a permanent header on all pages that provides a link for those who may be experiencing COVID-19 hardships.

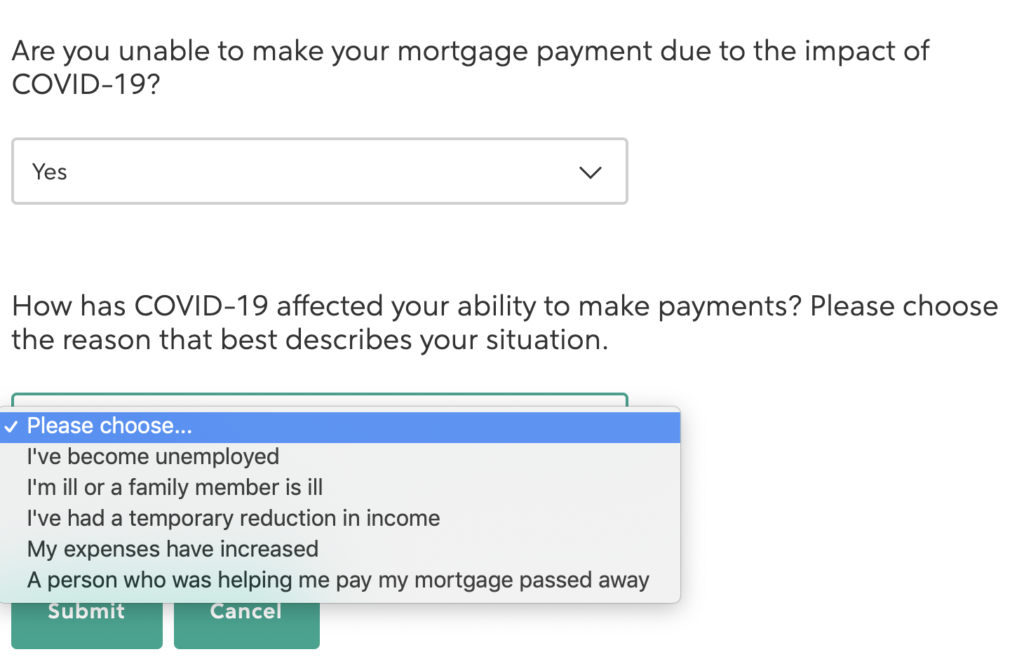

Clicking the link brings the borrower to a two question survey. Yes or no, you’re unable to make payments? And, as you see below, how has COVID-19. affected your ability to make those payments. For experiment’s sake, I chose “I’ve had a temporary reduction in income.” See below for the results.

Below is the exact text (in italics) of the plan we were offered because we selected “temporary reduction in income.”

You’re approved for a 3-month forbearance plan.

Please read the details below to understand the terms of your plan.

We won’t start your forbearance plan until you click “Accept My Plan.”

Your Payments Will Be Paused For 3 Months

Your forbearance plan begins April 1, 2020. That means you won’t be required to make your April, May and June payments. However, paying what you can during those months will benefit you later; you’ll owe less, so it will be easier to catch up.

Any payments that are paused during forbearance won’t be reported late to the credit bureaus. You’ll still receive monthly billing statements that show the unpaid amounts, so you understand what you have to pay at the end of your forbearance.

We’ll check in with you monthly during your forbearance. It’s important that we get in touch with you so we can review your situation and determine your next steps.

What Happens At The End Of Your Plan

Your current forbearance will end on June 30, 2020. On July 1,2020, you’ll be required to pay your July payment plus the past-due amount: That includes your April, May and June payments, plus any payments that were past-due before your plan began, if applicable.

Once the forbearance ends, the quickest way to get back on track is to pay the past-due amount in a lump sum. However, we understand that not everyone will be able to do that. Here are some other options you might have to pay the past-due amount:

- Apply for a repayment plan. If you’re approved, you’ll be able to pay a portion of your past-due amount each month in addition to your regular mortgage payment.

- Apply for a loan modification. If you’re approved, we’ll modify the terms of your existing loan to include your past-due payments and get you back on track.

You Can Extend Your Forbearance, If Necessary

At the end of your plan, you’ll have the option to extend your forbearance. This may be right for you if you need more time before resuming payments.

If you extend your forbearance, you’ll still need to bring your loan current when your plan ends. That means making all the payments that were paused during forbearance, plus any payments that were past-due before your plan began, if applicable. An extended forbearance means a larger amount you’ll need to bring current at the end of the plan.

What To Know Before Accepting Your Plan

If you can continue making your payments, it’s in your best interest to do so. Paying what you can during your forbearance will benefit you later; you’ll owe less, so it will be easier to catch up.

My Thoughts.

Couple of things to consider after this exercise.

First, I wonder if the term of the offered forbearance would vary depending on the hardship selected. Under the Act, a borrower may get 180 days of forbearance and then another. Based on my selection (“temporary reduction in income”), I was only offered 90 days. Something to think about.

Second, what’s really going to happen AFTER the forbearance. It is, of course, worrisome that the language of this agreement says “the quickest way to get back on track is to pay the past-due amount in a lump sum.” The servicer does, however, provide options. If a forbearance is something that may be of value to you and your family during this crisis, it is important to understand all of the terms of the forbearance. Make sure you’ve done that before clicking “Accept”!